Identity theft in the digital age happens even more frequently than it did before the internet. Today, someone doesn’t need to get your physical credit card or go through your trash to gather enough information about you to take out loans in your name. One wrong click on a phishing email can let a hacker into your computer and give them all the data they need for cloud account jacking, credit card fraud, and more.

watch short video > https://youtu.be/eiPUQUJUYAk

Identify theft happens when a criminal uses your PII – Personally Identifiable Information to pose as you and commit fraud or gain another financial benefit of some type. And this doesn’t only happen to individuals, small businesses can also suffer identity theft and have their business details used to take out a loan.

If your computer isn’t properly protected and you’re not using good password habits, then you’re at risk of becoming a victim of an identity or account breach.

In 2020, Americans lost $56 billion to identity fraud, losing an average of $1,100 per scam.

How Do Thieves Get Your Data?

There are several ways, both offline and online, that thieves can get your personal data:

- Phishing emails with a dangerous link or attachment

- Skimming using a fake card reader over a real one

- Wi-Fi hacking

- Buying information on the Dark Web that’s been exposed in a major data breach

- Phone scams

- Social media phishing scams

- Hacking passwords for online accounts

How to Prevent Identity Theft of Your Personal or Business Details

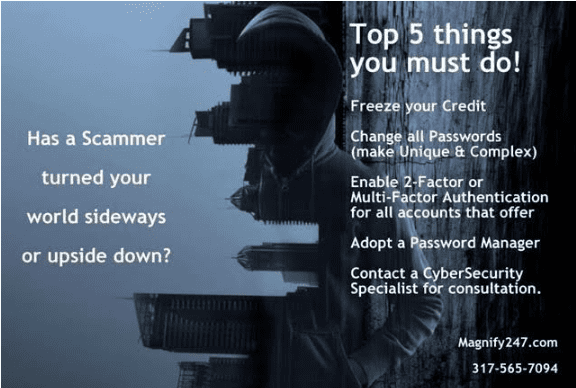

1. Freeze Your Credit

One way that businesses fall victim to identity theft is to have their FEIN, address, and other company details used to open a business loan or credit card. If a thief has enough information, they can pose as the business owner and get a line of credit in your company’s name.

To prevent the issuance of credit in your name, you can lock your credit with all four credit agencies if you aren’t intending to open a new credit account anytime soon.

You can find details on how to do that at these links:

- Transunion Credit Freeze: https://www.transunion.com/credit-freeze

- Equifax Credit Freeze: https://www.equifax.com/personal/credit-report-services/credit-freeze/

- Experian Freeze Center: https://www.experian.com/freeze/center.html

- Innovis Security Freeze: https://www.innovis.com/personal/securityFreeze

2. Change All Your Passwords

It’s important that you and, if you have a company, all your employees have strong passwords on all accounts. You should change all passwords, ensuring that strong, unique passwords are in place

77% of cloud account breaches happen due to compromised passwords. Changing all passwords to ones that are difficult to hack will reduce the risk of a hacker logging in as you or an employee and being able to access all kinds of sensitive data that can be used for fraud or identity theft.

3. Enable Multi-Factor Authentication on All Your Accounts

One of the best ways to combat the rise in password theft and protect your personal and business data is by enabling multi-factor authentication (MFA) on all accounts that have that capability.

The online criminal is rarely able to get past MFA because they won’t have the device that receives the authentication code. Thus, they’re locked out of your accounts even if they have the password.

4. Adopt a Password Manager

Most people want to and know they should be using strong and unique passwords for every login, but it’s impossible to remember all those passwords! So, they’re left with no choice but to use passwords they can remember (which are usually weak) and reuse the same password over multiple accounts.

A password manager solves this problem. It can suggest strong and unique passwords for every login, and you don’t have to remember them all. Users only need to remember one single strong password or passphrase to get to all the others.

5. Contact a Cybersecurity Specialist for a Consultation

People can often be victims of spyware and a persistent attack and not even know it. A persistent attack is when a hacker can continually get into your device or account because they haven’t been discovered. They use the same way in, through a backdoor or use of stolen login credentials to continue stealing data.

The best way to know if you’ve got a persistent attack happening is to consult with a cybersecurity specialist like Magnify247. We’ll take a thorough look at your system and ensure your data isn’t being breached without you realizing it.

We can also suggest safeguards to keep your data secure and protect you and your business from becoming an identity theft victim.

Some Free Advice for Everyone…

Don’t run the risk of a damaging cyberattack. Magnify247 can help your Hamilton County business

It really stinks that it’s mid-2021 and we’re still so reliant on passwords. But as long as that’s the case, I hope it’s clear that the smartest choice for all Internet users is to pick unique passwords for every site. The major web browsers will now auto-suggest long, complex, and unique passwords when users go to set up a new account somewhere online, and this is obviously the simplest way to achieve that goal.

Password Managers are ideal for people who can’t break the habit of re-using passwords because you only have to remember one (strong) master password to access all of your stored credentials.

If you don’t trust password managers and have trouble remembering complex passwords, consider relying instead on password length, which is a far more important determiner of whether a given password can be cracked by available tools in any timeframe that might be reasonably useful to an attacker.

In that vein, it’s safer and wiser to focus on picking passphrases instead of passwords. Passphrases are collections of multiple (ideally unrelated) words mushed together. Passphrases are not only generally more secure, but they also have the added benefit of being easier to remember.

Finally, there’s absolutely nothing wrong with writing down your passwords, provided; a) you do not store them in a file on your computer or taped to your laptop! and b) that your password notebook is stored somewhere relatively secure, i.e. not in your purse or car, but something like a locked drawer or safe.

Schedule a Cybersecurity Assessment Today!

Magnify247 can help your Hamilton County business with an assessment of your systems to ensure they’re clean of any spyware and suggest safeguards to keep your data more secure.